BUS 550 FINANCIAL MANAGEMENT COURSE ONLINE

Key Topics

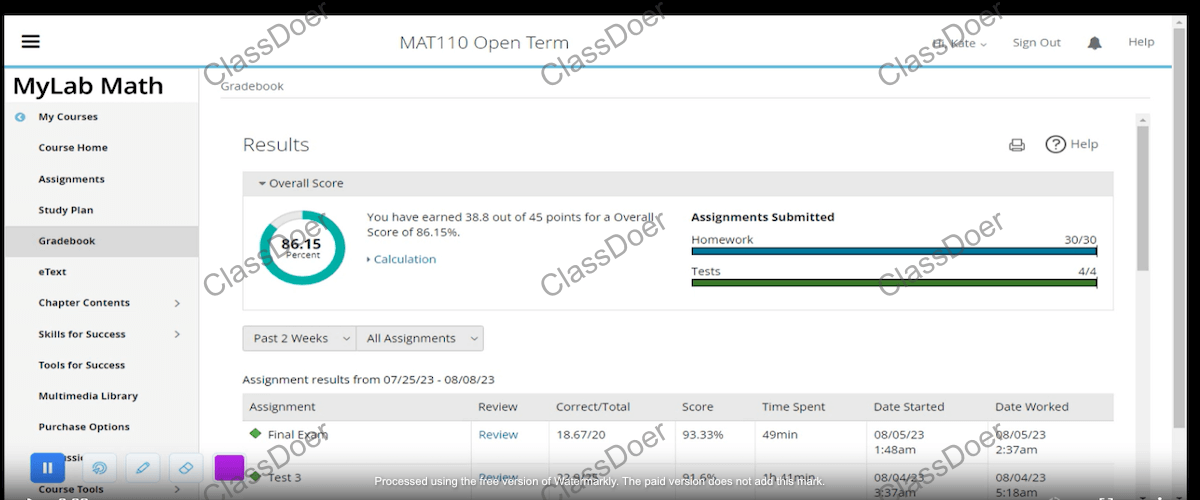

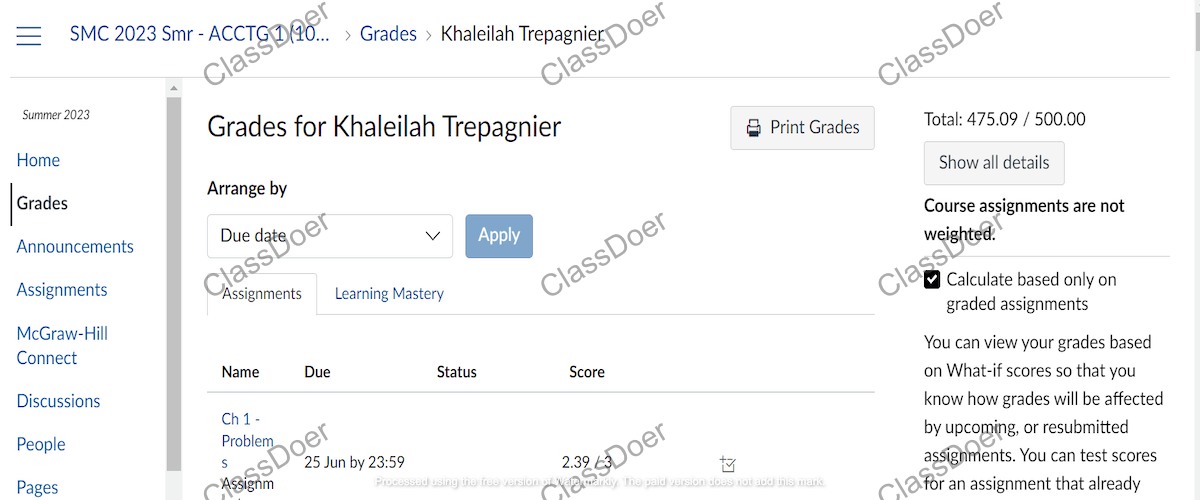

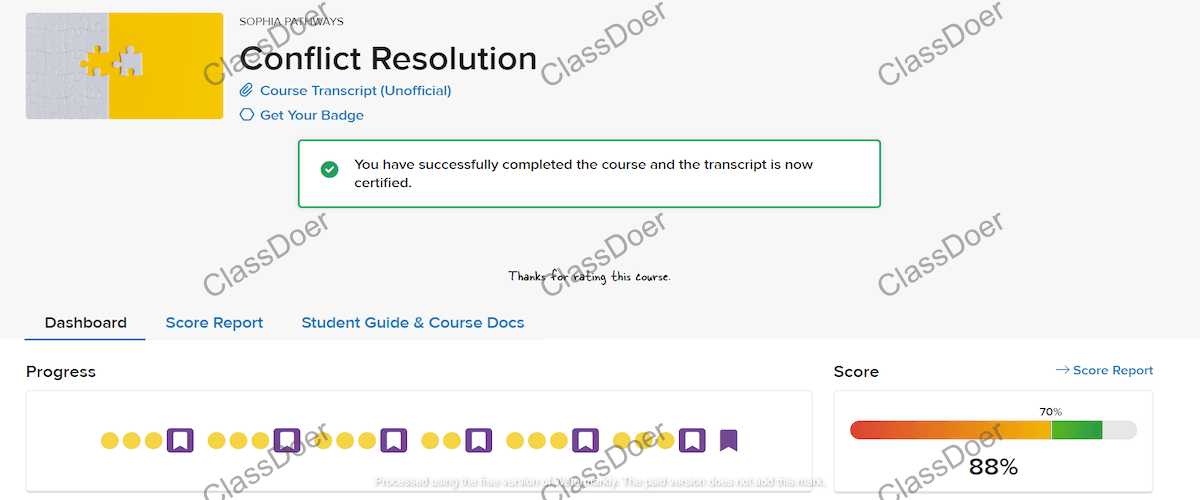

Get Help With BUS 550 Financial Management Course Online

BUS 550 Financial Management is a completely online course offered by Westcliff University's College of Business. This course is part of a master's degree programme in business administration that focuses on financial and managerial accounting principles. Under our online service, we cover all academic-related tasks such as online classes, exams, and quizzes. If you are willing to pay someone to do your class or exam for the BUS 550 Westcliff University course, you can buy help from us or hire one of our experts to help you.

Course Description

This is a three-unit programme that lasts eight weeks. This is an application-oriented financial and managerial accounting course. The course focuses on the principles of financial and managerial accounting that are used to make complex strategic and operational decisions.

The purpose of this course is to provide decision-makers with the financial and managerial accounting theory, concepts, and tools they need to make better financial management decisions, as well as to enable students to make informed judgments about other people's financial analyses.

Details of Required Texts For BUS 550

Ross, S. A., Westerfield, R. W., & Jordan, R. D. (2019).

Fundamentals of corporate finance (12th ed.). McGraw-Hill

Print ISBN: 978-1259918957

eText ISBN: 978-1260153651

Method of Instructions

Students communicate with one another and with professors in both a classroom setting and an online learning system. Learning will be aided by lecture discussions, presentations, cooperative learning, and case studies.

BUS 550 financial management Course Scope

Professional individual assignments, discussion postings, thorough learning tests, and class participation are used to assess student outcomes.

Course Learning Outcomes (CLOs) Linked to Program Outcomes

Learning outcomes define what a student will know and be able to do at the end of a course - the essential and enduring knowledge, abilities (skills), and attitudes (values, dispositions) that make up the integrated learning required of a course graduate.

The learning outcomes for this course explain what students should expect to learn and how this course relates to the MBA degree's educational goals.

| Course Learning Objectives (CLOs) | MBA Program Objectives |

(K) Knowledge (S) Skill (A) Attitude |

| 1. Recall accounting and finance vocabulary, terminology, charts, tables, equations, and calculations. | 1, 2, 3, 9 | K, S |

| 2. Analyze and evaluate a Balance Sheet, Income Statement, and Statement of Cash Flows. | 1, 2, 3, 6, 9 | K, S |

| 3. Calculate and evaluate Present Value, Future Value, Net Present Value, Internal Rate of Return (IRR), Profitability Index (PI), and Coefficient of Variance (CV) as applied in capital investment projects. | 1, 2, 3, 6, 9 | K, S |

| 4. Evaluate short-term versus long-term investment decisions, increasing shareholder values. | 2, 6, 8 | K, S |

| 5. Compile technical and strategic investment principles. | 1, 2, 6 | K, S, A |

| 6. Determine and evaluate the performance of a well-diversified portfolio. | 4, 6, 7, 9 | K, S |

| 7. Distinguish and apply the principles of T-accounts, debits, and credits. | 1, 2, 4, 6, 9 | K, S |

CLA Linking Table

Course Learning Outcomes are measured directly by Comprehensive Learning Assessments (CLAs), Professional Assignments (PAs), and Discussion Questions (DQs), whereas MBA Program Outcomes are measured indirectly by CLAs, PAs, and DQs.

The table below illustrates how they are all connected.

| Comprehensive Learning Assessments (CLAs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| CLA 1 (Week 4) | 1, 2, 3, 4, 5, 7 | 1, 2, 3, 4, 6, 8, 9 |

| CLA 2 (Week 8) | 1, 2, 3, 4, 5, 6, 7 | 1, 2, 3, 4, 6, 7, 8, 9 |

PA Linking Table

| Professional Assignments (PAs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| PA 1 (Week 2) | 1, 2, 5 | 1, 2, 3, 6, 9 |

| PA 2 (Week 6) | 1, 2, 3, 4, 5, 6, 7 | 1, 2, 3, 4, 6, 7, 8, 9 |

DQ Linking Table

| Discussion Questions (DQs) | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| DQ 1 (Week 2) | 1, 2, 5 | 1, 2, 3, 6, 9 |

| DQ 1 (Week 6) | 1, 2, 3, 4, 5 | 1, 2, 3, 6, 8, 9 |

| DQ 1 (Week 7) | 1, 2, 3, 4, 5, 6, 7 | 1, 2, 3, 4, 6, 7, 8, 9 |

Activity Linking Table

| Activity | Course Learning Outcomes (CLOs) | MBA Program Outcomes |

| Activity 1 (Week 1) | 1, 2, 5 | 1, 2, 3, 6, 9 |

| Activity 2 (Week 3) | 1, 2, 3, 4, 5, 7 | 1, 2, 3, 4, 6, 8, 9 |

| Activity 3 (Week 5) | 1, 3, 4, 5, 6 | 1, 2, 3, 4, 6, 7, 8, 9 |

BUS 550 Westcliff University Course Outline

The following outline provides important assignment instructions for this course week by week. You are solely responsible for all of the tasks you have been assigned. You can, however, ask us to do my assignment for me online if you are unable to complete your tasks. We have experts who can complete all of your assignments for you, and do so flawlessly.

-

Week 1

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 1: Introduction to Corporate Finance

Chapter 2: Financial Statements, Taxes, and Cash Flows

- Submit Activity 1 by Sunday at 11:59 p.m.

Activity 1 – CLO 1, CLO 2, CLO 5

ABC Company had $395,00 in additional retained earnings for the fiscal year that just concluded. The company paid a cash dividend of $195,000 and ended with $5.3 million in total equity. There are now 170,000 shares of ordinary stock outstanding in the corporation. Please respond to the following questions:

- What is E/PS (earnings per share)?

- What are the dividends per share?

- What is the share's book value?

- What is the market-to-book ratio of a stock that now sells for $64 per share?

- What is the price-to-earnings (P/E) ratio?

- With $5.15 million in sales, what is the price-to-sales ratio (P/S)?

Provide your explanations and definitions in detail and be precise. Provide your work in detail and explain in your own words.

-

Week 2

Assignments to complete this week:

- Reading: Fundamentals of Corporate finance

Chapter 2: Financial Statements, Taxes, and Cash Flows

Chapter 3: Working with Financial Statements

- Post DQ Direct Response by Thursday at 11:59 p.m.

- Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Submit Professional Assignment 1 by Sunday at 11:59 p.m.

Discussion Question Information: Answer all questions thoroughly and be sure to provide one (1) direct response to the discussion question prompt and one (1) peer response.

Discussion Question 1 – CLO 1, CLO 2, CLO 5

Please respond to the following scenario/questions in a 200-250 word response:

Examine the fictional company Balance Sheet in Chapter 2: Table 2.1 of the textbook and the fictitious company Income Statement in Chapter 2: Table 2.2 of the textbook.

- What do you think each of these items means in terms of financial management?

- Why did you respond in this manner?

Professional Assignment 1 – CLO 1, CLO 2, CLO 5

Find the most current income statement and balance sheet of a significant firm using Yahoo Finance and/or any other trustworthy source(s), then supply the following information:

1. Type these statements in the correct format (financial statement)

2. Conduct a vertical financial analysis that includes the following factors

- Debt ratio

- Debt to equity ratio

- Return on assets

- Return on equity

- Current ratio

- Quick ratio

- Inventory turnover

- Days in inventory

- Accounts receivable turnover

- Accounts receivable cycle in days

- Accounts payable turnover

- Accounts payable cycle in days

- Earnings per share (EPS)

- Price to earnings ratio (P/E)

- Cash conversion cycle (CCC), and

- Working capital

- Explain Dupont's identity. Apply it to your selected company. Interpret the components in Dupont identity.

Explanations and definitions should be specific and detailed. Make a comment about what you've learned. Include content references as needed. Make a detailed description of your work in your own words.

-

Week 3

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 4: Long-Term Financial Planning and Growth

Chapter 5: Introduction to Valuation, the Time Value of the Money

Chapter 6: Discounted Cash Flow Valuation

- Submit Activity 2 by Sunday at 11:59 p.m.

Activity 2 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 7

Assume that if you retired right now, you'd need $50,000 per year to supplement your social security and maintain your preferred lifestyle. Given annual inflation of 3%, retiring 30 years from now will necessitate more than $50,000 per year to maintain the lifestyle you desire.

- How much will $50,000 be worth in retirement, adjusted for inflation?

- What is the face value of the bond with a face value of $50,000 and a coupon payment of $50,000, as shown in Part B #4?

- How much money should you put into a retirement account each year to accumulate the funds needed to buy the bond when you retire?

- In terms of the current value of the dollar at the time the retirement account was opened, what is the purchasing power of the amount your heirs will receive?

(Hint: First figure out what the future value will be in 30 years, which is $50,000 right now, and then solve the rest of the issue.)

-

Week 4

Assignments to complete this week:

Reading: Fundamentals of Corporate Finance

Chapter 6: Discounted Cash Flow Valuation

Chapter 9: Net Present Value and Other Investment Criteria

Chapter 10: Making Capital Investment Decisions

Chapter 11: Project Analysis and Evaluation

- Submit CLA 1 by Sunday at 11:59 p.m.

CLA 1 Comprehensive Learning Assessment – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 7

Please keep in mind that this CLA 1 assignment is split into two parts. The cash flows for two mutually exclusive projects are shown in the first component, which is unrelated to the second. In the second section, a capital budgeting scenario is presented.

-

Week 5

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 6: Discounted Cash Flow Valuation

Chapter 7: Interest Rates and Bond Valuation

Chapter 8: Stock Valuation

Chapter 9: Net Present Value and Other Investment Criteria

Chapter 10: Making Capital Investment Decisions

Chapter 11: Project Analysis and Evaluation

- Submit Activity 3 by Sunday at 11:59 p.m.

Activity 3 - CLO 1, CLO 3, CLO 4, CLO 5, CLO 6

Please complete both portions of this activity.

Part - 1

A and B are identical bonds in terms of credit rating, par value, and coupon rate. Bond A will be 30 years old in 30 years, while Bond B will be 5 years old in 5 years. To demonstrate your understanding of interest rate risk, please answer the following questions:

- Discuss which bond will trade at a higher price in the market.

- Discuss what happens to the market price of each bond if interest rates rise in the economy.

- Which bond will experience a greater percentage price change if interest rates rise?

- Please support your claim with numerical evidence.

- How would you invest in bonds as a bond investor if you think the economy will slow down in the next 12 months?

Part - 2

Random variables must be understood in order to grasp the fundamentals of portfolio theory. You'll want to brush up on your random variable handling skills since the CLA 2 assignment is about portfolio construction. Please go over the basics of random variable concepts like mean, variance, standard deviation, and correlation and explain why they are important.

-

Week 6

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Chapter 8: Stock Valuation

Chapter 12: Some Lessons from Capital Market History

Chapter 13: Return, Risk, and the Security Market Line

Chapter 14: Cost of Capital

- Post DQ Direct Response by Thursday at 11:59 p.m.

- Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Submit Professional Assignment 2 by Sunday at 11:59 p.m.

Discussion Question 1 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5

Please respond to the following questions in a 200-250 word response, and back your position with peer-reviewed evidence:

On this basis, compare and contrast the risk versus an expected rate of return tradeoff, the security market line, and beta determination.

- Include a description of each component, such as the security market line, risk measure, estimated rate of return, risk-free rate of return, and market rate of return, among others.

- Use hypothetical examples for more clarity.

What is the meaning of the weighted average cost of capital (WACC)?

- For more clarity, can you think of two hypothetical examples?

Professional Assignment 2 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 6, CLO 7

Part 1 of the PA 2 focuses on analyzing beta and WACC, while Part 2 focuses on data collection in preparation for the CLA 2. To demonstrate your detailed appraisal of the company's opportunity cost as well as your skills in acquiring and organizing historical data on securities for the goal of portfolio creation, you must complete both components in your 3-5-page, APA-formatted report.

-

Week 7

Assignments to complete this week:

Reading: Fundamentals of Corporate Finance

Chapter 11: Project Analysis and Evaluation

Chapter 13: Return, Risk, and the Security Market Line

Chapter 14: Cost of Capital

- Post DQ Direct Response by Thursday at 11:59 p.m.

- Post DQ Peer Response(s) by Sunday at 11:59 p.m.

- Complete quiz by Sunday at 11:59 p.m.

Discussion Question 1 – CLO 1, CLO 2, CLO 3, CLO 4, CLO 5, CLO 6, CLO 7

The ABC Company has engaged you to explain how to evaluate a security's performance using the expected rate of return, the standard deviation of the rate of return, and coefficient of variation (CV).

They also want you to show how, by putting together a portfolio, you can create an instrument with better qualities than each of its elements in terms of the standard deviation of the rate of return and CV.

In a 200-250-word response, how would you explain and present this information to ABC Company, backed up by relevant academic and peer-reviewed data?

Quiz - Online

The quiz can be found on your course GAP site under Week 7. The quiz will begin on Monday and end at 11:59 p.m. on Sunday. You will only be given one (1) chance to complete the quiz. Please consult the University Policies for Grading Criteria for Exams and Quizzes.

-

Week 8

Assignments to complete this week:

- Reading: Fundamentals of Corporate Finance

Review all chapters covered that will assist in the completion of the CLA 2 assignment

- Present CLA 2 Presentation during the last class meeting

- Submit CLA 2 by Sunday at 11:59 p.m.

CLA 2 Comprehensive Learning Assessment 2 – CLO 1, CLO 3, CLO 4, CLO 5, CLO 6, CLO 7

This is a Word document that contains a detailed written report on how your portfolio was created. Paste your historical data and applicable derived values from tables into the Excel file created by previous calculations. In Word format, please provide explanations and reasons for all calculations. Also, make sure that all of the underlying Excel formulae that were used in the computations are pasted into the Word document.

- Give the information you gave in Part 2 of Professional Assignment 2 a second time.

- Calculate the mean, variance, and standard deviation of each security's annual rate of return.

- Calculate the correlation coefficient between every possible pair of securities' annual rates of return.

- Determine how much of your initial investment will go into each of the five (5) securities (weights in the portfolio).

- Find the weighting combination that reduces the portfolio's CV.

- Assume you put $1,000,000 into the portfolio at the start, and the portfolio's annual rate of return has a normal distribution.

98% of our client Scored A/B

98% of our client Scored A/B No Guaranteed Grade

No Guaranteed Grade